BTI 2014 LLC v Sequana SA & Ors [2022] UKSC 25 (05 October 2022)

Citation:BTI 2014 LLC v Sequana SA & Ors [2022] UKSC 25 (05 October 2022).

Subjects invoked: 7. 'Company'.43. 'Insolvency'.

Rule of thumb:If a company goes bust, can dividends paid out to shareholders be reclaimed from shareholders & directors by the liquidator? Yes, but it would be very rare from shareholders. The shareholders would have to know that the company was trading whilst insolvent, which although possible, is extremely hard if not impossible to prove in 99.9% of case. It is also extremely hard to prove that the company had no chance of survival when the dividends were given out – it is always possible to argue that a big shareholding deal could have been struck which could still have saved the company ensuring that it was not technically trading whilst insolvent beyond all reasonable doubt to make the directors liable for dividend distributions.

Background facts:

This case invoked the subjects of company law and insolvency law. Under company law it invoked the principle of ‘director’s duty’, and under insolvency law it invoked the principle of ‘clawback’ for illegal dividend distributions to shareholders.

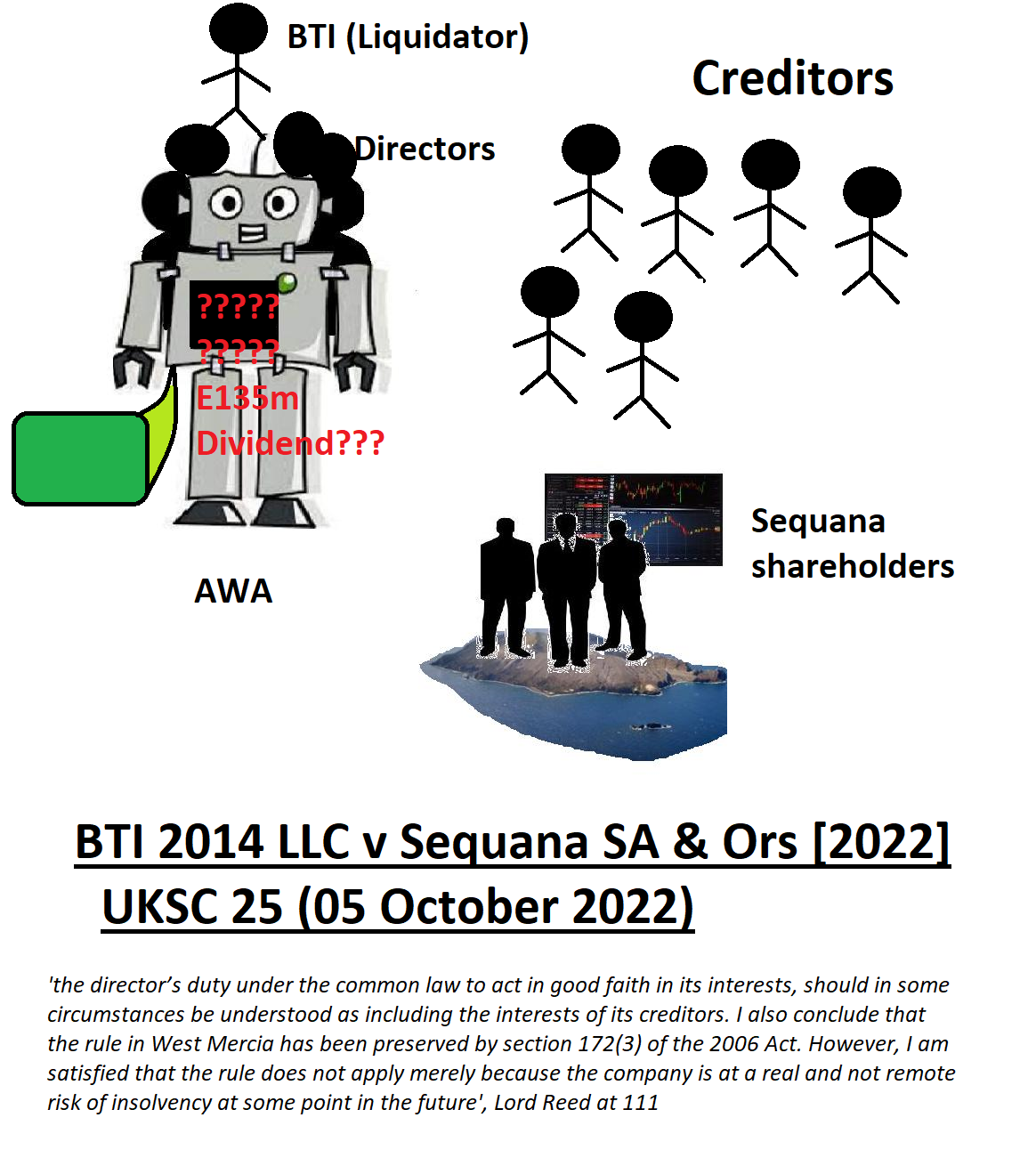

Only the most basic facts of this case were needed to be put across by the Court – this was a highly technical legal argument rather based upon fairly straightforward facts. The basic facts were that AWA was a company who in 2009 gave out a E135m dividend to their shareholder Sequana. There were 5 directors on the AWA board who did this. These 5 directors of AWA and their shareholder Sequana were the 6 listed defender-respondents in the case. In 2018 AWA went into insolvency with massive debts. BTI was the liquidator who represented many third parties who AWA owed debts to when they went bust, and BTI took over AWA when they went into insolvency. BTI was therefore pursuer-plaintiff in this case trying to get this E135m back from Sequana and the directors from AWA who gave it out were the defender-respondents.

BTI sought to argue that this distribution of E135m by the directors to Sequana in 2009 was a breach of these directors’ duty. BTI sought to argue that this distribution meant that AWA technically became insolvent, as they had a big pollution problem at that time, which they had to spend a lot of money on to fix in the 9 years after this distribution. In other words, BTI essentially argued that this E135m should have been used to fix the pollution problem, rather than distribute this to shareholders, and this would have meant that they would still have been solvent and trading commercially 9 years later. BTI argued that this E135m by AWA directors to Sequana made AWA become insolvent and was therefore technically an illegal dividend distribution. BTI therefore sought to argue that this E135m dividend was a transaction which was illegal, and which should be recovered. BTI therefore sued the directors for breach of company law in making this distribution of dividends which they stated was unlawful in breach of company law, and they also sought to sue Sequana under insolvency law to pay this E135m back. In other words, BTI sought to get the directors and the shareholder, Sequana, to pay them this E135m using company law and insolvency law. The former directors of AWA and their shareholder Sequana naturally put up a defence to this. These arguments between BTI against the directors and Sequana essentially came down to an expert accounting evidence. BTI argued that this distribution made AWA insolvent according to its expert accounting report, whereas Sequana & its 5 directors argued that it was not technically insolvent according to their expert accounting report, as Sequana and its directors argued that in the 9 years after this there were lots of things that could have been done to keep AWA trading.

Judgment:

The Court essentially accepted the evidence from the expert accountants representing Sequana and the former AWA directors, stating that after this E135m dividend distribution AWA did not technically become insolvent as being more credible and reliable so the directors were not liable for it, and there was absolutely no way that the shareholders could have known this meaning that they were nowhere near liable to pay this back.

The Court found the arguments of the accounts explaining that during the 9 years after the E135m dividend distribution by the AWA directors to Sequana, AWA could have still have been run in such a way that it could have survived as a profitable organisation, meaning that AWA was not technically insolvent after the distribution. This E135m dividend was therefore held not to have breached any company laws nor did it trigger insolvency laws entitling it to be repaid. The Court basically upheld this accounting report that this distribution did not make AWA insolvent, and so the liquidator, BTI, acting on behalf of the creditors was not entitled to get this E135m back. The Court did affirm that if the accounting evidence had stated that this distribution did technically make AWA insolvent at the time of this dividend, then it would have been arguable that the directors may have been made liable, and in some extreme circumstances, a shareholder may have to repay a dividend as well, but this case was not an example of one where this could be done. In short, if dividend distributions make a company clearly insolvent, it is possible that the directors may be made personally liable for these, and the shareholders who receive them may even have to pay them back if it is widely known that the organisation was insolvent at the time, but AWA was not an example of this actually taking place. In short, BTI lost, and Sequana and its 5 directors won – Sequana and the former AWA directors did not have to repay the E135m shareholder dividend they distributed to BTI.

Ratio-decidendi:

115. The resolution of the issues in this appeal is not fact-sensitive. In a nutshell, the facts concern a company called AWA. In May 2009 AWA’s directors, who are the second and third respondents, caused it to distribute a dividend of €135m (“the May dividend”) to its only shareholder, the first respondent Sequana SA, which extinguished by way of set-off almost the whole of a slightly larger debt which Sequana owed to AWA. It is common ground in this court that the May dividend was lawful, in the sense that it complied with the statutory scheme regulating payment of dividends in Part 23 of the 2006 Act and with the common law rules about maintenance of capital. Furthermore the May dividend was distributed at a time when AWA was solvent, on both a balance sheet and a commercial (or cash flow) basis. Its assets exceeded its liabilities and it was able to pay its debts as they fell due. But it had long-term pollution-related contingent liabilities of a very uncertain amount which, together with an uncertainty as to the value of one class of its assets (an insurance portfolio), gave rise to a real risk, although not a probability, that AWA might become insolvent at an uncertain but not imminent date in the future. In the event AWA went into insolvent administration almost ten years later, in October 2018. The Appellant BTI 2014 LLC sought, as assignee of AWA’s claims, to recover an amount equivalent to the May dividend from AWA’s directors on the basis that their decision that AWA should distribute the May dividend was a breach of the creditor duty. Meanwhile AWA’s main creditor applied to have the May dividend set aside as a transaction at an undervalue intended to prejudice creditors, under section 423 of the Insolvency Act 1986. Lord Briggs

111. For the reasons which I have explained, I conclude that English law recognises a rule, which I have referred to as the rule in West Mercia, according to which the interests of a company, for the purposes of the director’s duty under the common law to act in good faith in its interests, should in some circumstances be understood as including the interests of its creditors. I also conclude that the rule in West Mercia has been preserved by section 172(3) of the 2006 Act. However, I am satisfied that the rule does not apply merely because the company is at a real and not remote risk of insolvency at some point in the future. It therefore does not apply in the circumstances of the present case. This appeal should accordingly be dismissed. Lord Reed

Warning: This is not professional legal advice. This is not professional legal education advice. Please obtain professional guidance before embarking on any legal course of action. This is just an interpretation of a Judgment by persons of legal insight & varying levels of legal specialism, experience & expertise. Please read the Judgment yourself and form your own interpretation of it with professional assistance.