Balhousie Holdings Ltd v Revenue and Customs (Scotland) [2021] UKSC 11 (31 March 2021)

Citation:Balhousie Holdings Ltd v Revenue and Customs (Scotland) [2021] UKSC 11 (31 March 2021)

Subjects invoked: 11. 'Legal Methods'.44. 'Heritable Property'.81. 'Transactional taxes'.

Rule of thumb:Is selling a business-purpose property ready to be traded from immediately the sale of a business? No, this is considered to be the sale of a property.

Background facts:

This case invoked the subjects of legal methods, heritable property and transactional tax. In terms of legal methods, the Court firstly affirmed that it is the case-law with facts which most closely fits to the facts of the case at hand which must be applied. The Court also affirmed in terms of VAT that if a business owns the property they are currently in, and they then sell this property to an investor, but at the same time agree a 20 year-long lease with the investor to remain in the property after the sale, then this is a property transaction and not the sale of a business giving rise to VAT obligations.

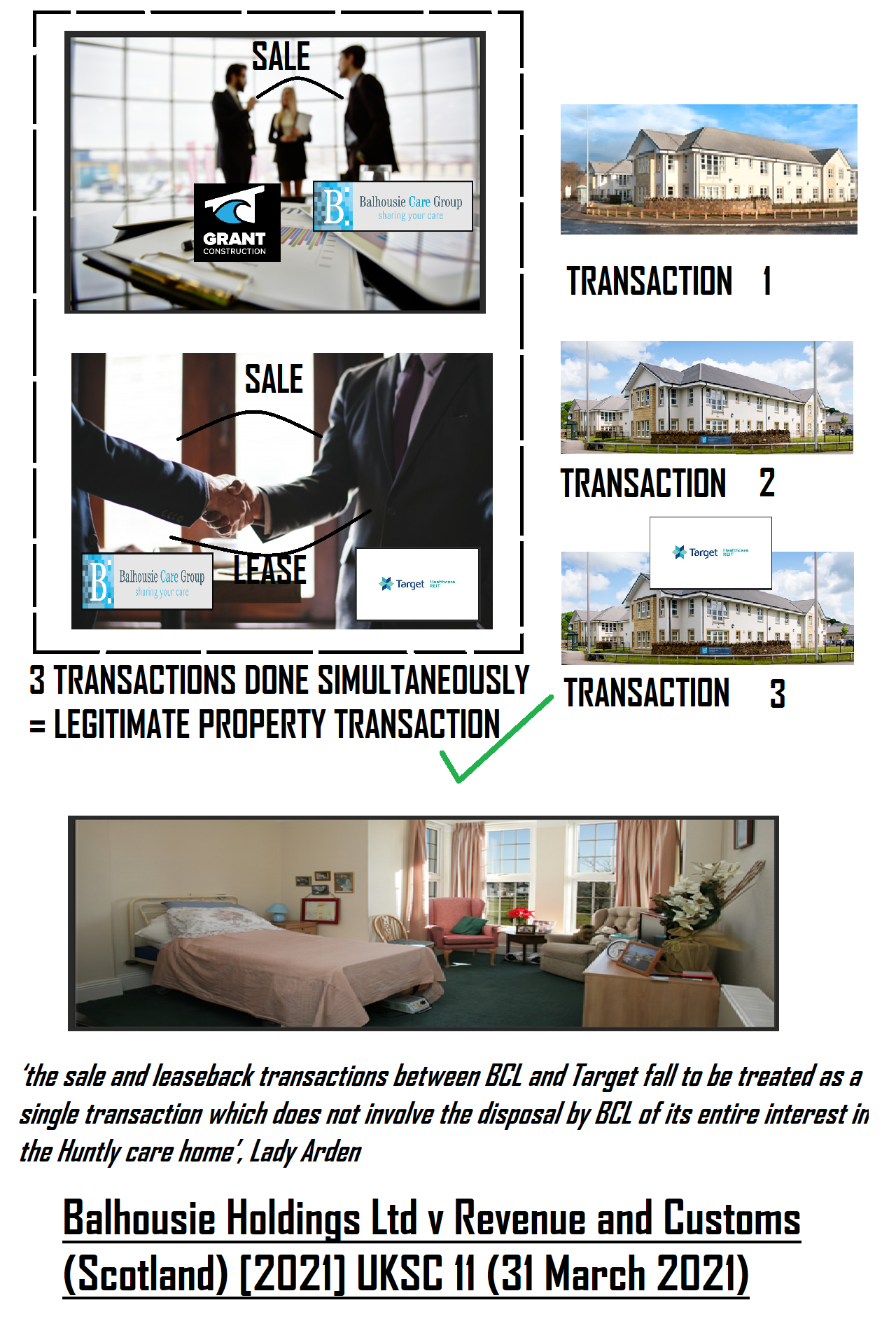

The facts of this case were that ‘Grant’ (also known as Faskally), a property developer, built a care-home. It called this the ‘Huntly Care-Home’ and put it up for sale. This was a new care-home which Grant/Faskally got no elderly residents into, and had no intention of getting resident into - ‘Grant’/Faskally was not a carer and was a builder. ‘Balhousie’, a company who provided care services, agreed to purchase this new property from ‘Grant’/Faskally. ‘Balhousie’ agreed that they would be sold the property from ‘Grant’/Faskally, and this would be entered in the land register as having been done to make ‘Balhousie’ the owner, but ‘Balhousie’ would pay the price for the property some time after the transaction was entered in the land register. Balhouise also obtained a license for the property to operate commercially. Once Balhousie was the owner of the property in the land register, Balhousie then agreed to sell the property at a profit to ‘Target’, an investment company. However, at the same time as this sale of the Huntly care home from Balhousie to Target, Balhousie also agreed a 20 year lease with Target to remain there. Balhousie, using the money they received from Target, then paid Grant, and also had a tidy profit in their hands. Stamp duty land tax was paid on both transactions – the money paid from Target to Balhousie, and then Balhousie to Grant. HMRC told Balhousie they were not happy with this. HMRC stated that they wanted VAT to be paid on the payment they made to ‘Target’ as they considered this the sale of a care-home business to Target. Balhousie refused to pay the VAT claiming that this was a heritable property transaction with Target requiring Stamp-duty only to be paid, so the matter went to Court. Stamp duty land tax is 5-12% on the transaction value and VAT is 20%, meaning that Balhousie had potentially underpaid £800k.

Both parties agreed that the principle of ‘effective/entire transfer of a business’ was potentially invoked, and this was the matter in dispute. This principle essentially means that if someone buys a key asset of a business, or several assets of a business, without buying all the business assets, they can still be deemed to have effectively bought the entire business – where the line of ‘effective transfer’ with this principle always sparks debates. This basically required the agreement between Balhousie and Target to be studied closely to decide if Balhousie had basically sold Target a care-home business or not. VAT is a matter which EU law applies to. This was a matter which essentially came down to studying the past EU case law and deciding which cases related most closely to the case at hand. Balhousie essentially argued that the case law held this to be a property transaction rather than the sale of a business, and HMRC basically argued that the case-law held this to be the transfer of a business rather than a standard property transaction. The Court essentially had to study the case-law and decide which applied more closely.

Judgment:

The Court held that the transaction between Balhousie and Target was not the transfer of a business, and instead was indeed a property transaction. Essentially, the Court just looked at the past case law of EU VAT decisions, and decided that the facts of this more closely resembled EU case law holding that transactions of that nature were not transfer of an entire business interest, meaning that VAT did not have to be paid. Balhousie did not have to pay any VAT on the sale to Target.

Ratio-decidendi:

‘62. HMRC further argue that the supply in Mydibel was in fact a supply of the principal sum loaned which would be exempt and would have no bearing on the ongoing use of input construction services by Mydibel in its continuing economic activity, and that that point explains why the CJEU felt that no adjustment to the initial input tax deduction was needed. However, it is quite clear from the judgment that the concern was adjustment of the prior entitlement to deduct. I am not therefore persuaded that there was any relevant difference between Mydibel and the present case. Conclusion 63. I conclude that paragraph 36(2) of Schedule 10 to VATA falls to be interpreted in accordance with the principles of EU VAT law, and that, when that sub-paragraph is so interpreted, the sale and leaseback transactions between BCL and Target fall to be treated as a single transaction which does not involve the disposal by BCL of its entire interest in the Huntly care home. For these reasons, I would allow this appeal’. ‘the sale and leaseback transactions between BCL and Target fall to be treated as a single transaction which does not involve the disposal by BCL of its entire interest in the Huntly care home’, Lady Arden

Warning: This is not professional legal advice. This is not professional legal education advice. Please obtain professional guidance before embarking on any legal course of action. This is just an interpretation of a Judgment by persons of legal insight & varying levels of legal specialism, experience & expertise. Please read the Judgment yourself and form your own interpretation of it with professional assistance.