PACCAR Inc & Ors, R (on the application of) v Competition Appeal Tribunal & Ors [2023] UKSC 28 (26 July 2023)

Citation: PACCAR Inc & Ors, R (on the application of) v Competition Appeal Tribunal & Ors [2023] UKSC 28 (26 July 2023)

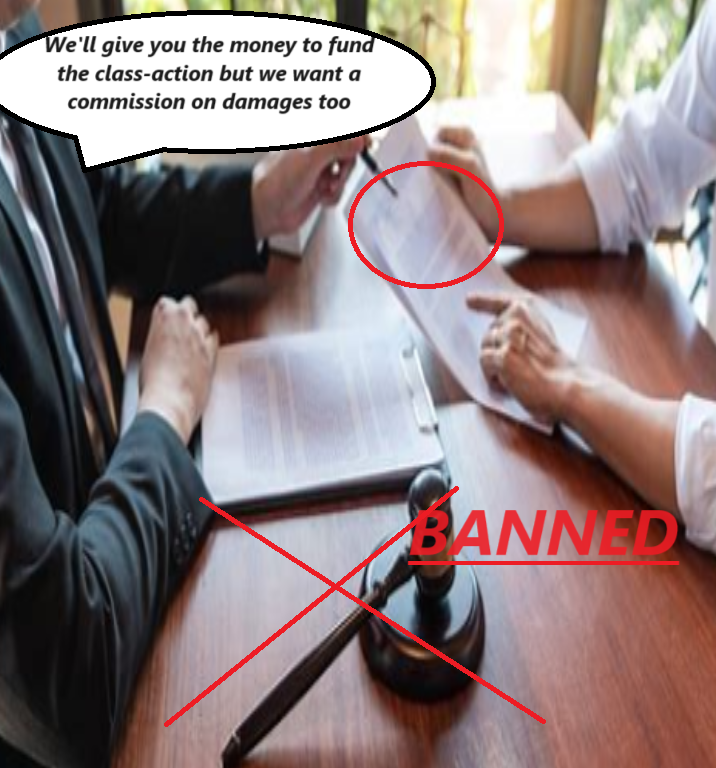

Rule of thumb: Stare-decisis:Can third-party banks financing Lawyers to run claims agree a term in these financing contracts where they are entitled to a commission on damages obtained? No, third parties providing the finance for claims cannot obtain commission on damages obtained – these funding agreements are illegal & in breach of FSMA 2000, CLAS 1990 & CJA 2009 so if lawyers are operating them the Court is not allowed to hear the case – for a person to be entitled to commission on damages they must be involved in handling/pursuing the claim.

Background facts: The basic facts of this case were that 5 truck manufacturers were found to have breached competition law in the trucks that they sold to many logistics/trucking companies.

Parties argued: Some claimant law firms offered logistics/trucking companies ‘no win no fee’ to sue the truck manufacturers. The Claimant law firms offering did this agreed a commission contract with financiers – the finances were entitled to a % commission on any damages that they obtained for winning the case on behalf of the logistics trucking/companies, and the financiers put in place all the money for the law firms to lodge the claims & then pursue them. The truck companies argued that these agreements were illegal & so there was no standing to pursue the claims.

Court held: The Court held that these types of financing agreements by financiers are illegal. Any person is only entitled to commission on damages if they have actually been involved in the actual advice & representation on the claim - the Court upheld that the truck manufacturers could not be sued by a law firm operating this type of financing agreement.

Ratio-decidendi:

1. The question which arises on this appeal is whether a form of arrangement for the financing of litigation by third party funders is lawful and effective. This depends on the interpretation of an express definition of a term as set out in a statute. The case concerns the proper interpretation of a definition first used in one statutory context and then adopted and used in another context…

3. The specific issue for determination is whether litigation funding agreements (“LFAs”) pursuant to which the funder is entitled to recover a percentage of any damages recovered constitute “damages-based agreements” (“DBAs”) within the meaning of the relevant statutory scheme of regulation (“the DBA issue”)…

23. As of 1 April 2019 responsibility for the regulation of claims management services was transferred from the Ministry of Justice to the Financial Conduct Authority pursuant to amendments to the Financial Services and Markets Act 2000 (“FSMA”), and the relevant provisions of the 2006 Act were repealed. Section 419A of FSMA defines claims management services in materially the same terms, as follows:

“419A Claims management services (1) In this Act ‘claims management services’ means advice or other services in relation to the making of a claim. (2) In subsection (1) ‘other services’ includes - (a) financial services or assistance, (b) legal representation, (c) referring or introducing one person to another, and (d) making inquiries, but giving, or preparing to give, evidence (whether or not expert evidence) is not, by itself, a claims management service.”

27. ‘A new section 58AA was inserted into the CLSA 1990 by section 154 of the Coroners and Justice Act 2009 (“the CJA 2009”) to introduce DBAs and make them enforceable subject to the satisfaction of certain conditions. As originally introduced section 58AA was limited to employment claims. However, that limitation was removed by section 45 of the Legal Aid, Sentencing and Punishment of Offenders Act 2012 (“LASPO”) with effect from 19 January 2013. For discussion of these changes, see Lexlaw Ltd v Zuberi [2021] EWCA Civ 16; [2021] 1 WLR 2729. As so amended, and so far as is material, section 58AA provides as follows:

“58AA Damages-based agreements (1) A damages-based agreement which satisfies the conditions in subsection (4) is not unenforceable by reason only of its being a damages-based agreement. (2) But … a damages-based agreement which does not satisfy those conditions is unenforceable. (3) For the purposes of this section— (a) a damages-based agreement is an agreement between a person providing advocacy services, litigation services or claims management services and the recipient of those services which provides that— (i) the recipient is to make a payment to the person providing the services if the recipient obtains a specified financial benefit in connection with the matter in relation to which the services are provided, and (ii) the amount of that payment is to be determined by reference to the amount of the financial benefit obtained…’

7. The appellants, truck manufacturers who are defendants in the proceedings in the Tribunal, maintain that the LFAs in this case constitute DBAs within the meaning of section 58AA. On that basis, the appellants say the LFAs are unenforceable by virtue of section 58AA because they did not comply with formality requirements made applicable by that provision. If this is right, the practical consequence would be that there is no proper basis on which a collective proceedings order could be made by the Tribunal in favour of UKTC or the RHA. The arrangements which have to be in place to support the making of a collective proceedings order include provision for payment of any costs order made in favour of the defendants in the proposed proceedings, and it would not be fair to authorise collective proceedings against them without proper and enforceable funding in that regard. More fundamentally, if the funding arrangements are not enforceable there is no effective agreement in place pursuant to which the funders will provide the financing necessary for the claims to be brought at all…

95. Section 47C(8) of the Competition Act 1998, as added by amendment in 2015, provides that “[a] damages-based agreement is unenforceable if it relates to opt-out collective proceedings”. Subsection (9)(c) states that “damages-based agreement” has the meaning given in section 58AA(3). Accordingly section 47C(8) creates an additional reason why UKTC’s opt-out LFA with Yarcombe is not enforceable. Unlike a DBA in relation to opt-in collective proceedings, there is no scope for a DBA in relation to opt-out collective proceedings to be made enforceable by compliance with the conditions stipulated in section 58AA’.

Lord Sales

Warning: This is not professional legal advice. This is not professional legal education advice. Please obtain professional guidance before embarking on any legal course of action. This is just an interpretation of a Judgment by persons of legal insight & varying levels of legal specialism, experience & expertise. Please read the Judgment yourself and form your own interpretation of it with professional assistance.